With mini, or ‘snap’ lockdowns mooted for areas of South Africa where Covid-19 infections have seen a renewed spike, economists at the University of Stellenbosch’s Bureau for Economic Research (BER) say this spells bad news for economic recovery in the country.

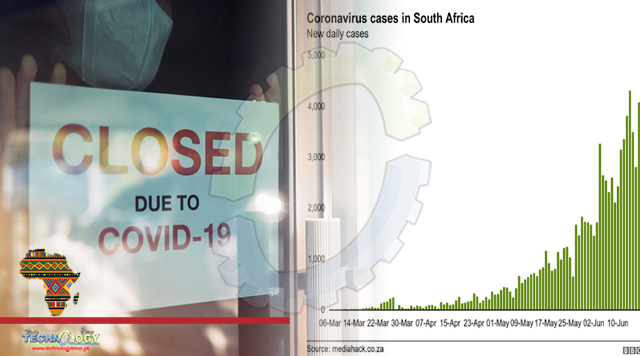

The BER noted that the whole of South Africa is seeing a steady rise in new coronavirus cases, with the seven-day rolling average now at about 2,900 daily cases, from 1,500 cases at the start of November.

This is still off from the 12,000-plus daily cases seen at the peak of the virus in June and July, but is showing a clear trend upwards.

The fresh surge is largely due to the spike in cases seen in the Eastern and Western Cape, the BER said, with authorities officially characterising it as a resurgence.

“The Western Cape government said that the province is now officially experiencing a resurgence of the virus as active cases jumped by more than 20%, week-on-week. In fact, new cases rose by more than 52% over the past week in the Western Cape with community transmission again established.

“The province issued a hotspot alert for the Garden Route as well as the City of Cape Town. George and Knysna recorded more new cases than during the peak of the nationwide pandemic in July. Health minister Dr Zweli Mkhize also expressed concern about the number of positive cases as well as rising hospital admissions and deaths from the virus in the Eastern Cape,” the BER said.

While the Western Cape government has made it clear that South Africa cannot afford another nationwide lockdown, it, along with the Eastern Cape, have mooted implementing tighter restrictions in hotspot areas – a type of mini lockdown, or ‘snap’ lockdowns, similar to those seen in Europe.

Weekend reports indicated that these localised lockdowns could be pegged at level 3, however, the BER questioned the plausibility or viability of implementing this level of restriction.

“While in theory, local, or ‘snap’ lockdowns could be a sensible approach to ensure that a region’s health system can cope with a sudden rise in cases, it will be challenging to implement this in practice – especially ahead of the festive season,” it said.

“Furthermore, local lockdowns will be a setback to the economic recovery in those regions.”

The main markers of lockdown level 3 included restrictions around on-site consumption of alcohol, leisure travel, social visits, large gatherings, and businesses with more than 100 employees.

Under these rules, people were prohibited from leaving their homes except to travel to and from work, to shop, to exercise during set hours or for emergencies. Hotels and accommodation were closed and domestic travel was prohibited for leisure purposes.

The BER said that a nationwide resurgence of Covid-19, especially if accompanied by the re-imposition of lockdown restrictions, would most definitely quell the ‘encouraging uptick’ that was observed in the latest business confidence index released last week.

The RMB/BER BCI rose to 40, up from 24 in Q3 and an all-time low of 5 in Q2.

“The improvement in business confidence was supported by a broad-based recovery in all sectors included in the index. However, the consumer-linked sectors performed much better than manufacturing and in particular building.

“While this does raise some questions about the sustainability of the improvement, the fact that some growth momentum seems to have been sustained from Q3 to Q4 was heartening,” it said.

Originally published at Business tech