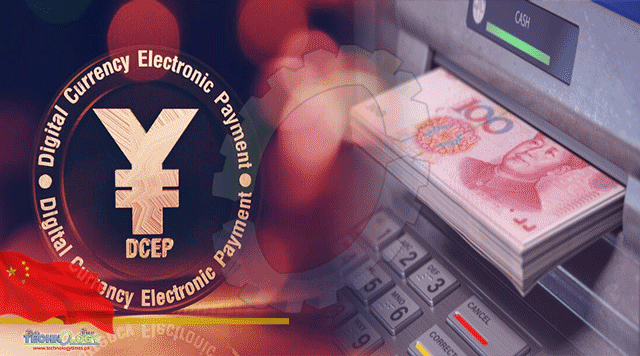

China Hopes To Increase Adoption Of Its Digital Yuan By Adding Support For The Currency At More Than 3,000 ATMs In Beijing.

- China has added support for the digital yuan at 3,000 ATMs in Beijing.

- China has conducted lotteries to boost the popularity of its digital currency. It’s distributed more than $40 million worth of digital yuan so far.

- China, the United Arab Emirates, and other partners are developing a global payment network based on CBDCs.

China Hopes To Increase Adoption Of Its Digital Yuan By Adding Support For The Currency At More Than 3,000 ATMs In Beijing. Citizens Will Be Able To Withdraw The Digital Yuan For Cash, And Vice Versa.

Digital Yuan

China is making the digital yuan available at more than 3,000 ATMs in Beijing, the Industrial and Commercial Bank of China (ICBC) has announced. China was the first country to implement a central bank digital currency (CDBC). The digital yuan has proven popular, particularly since the Coronavirus pandemic hit the country.

Citizens will be able to use the ATMs to convert digital yuans to cash, and vice versa. Prior to this announcement, only 10 ATMs in Beijing supported the digital currency. It’s the next step in a national rollout that’s seen the digital yuan launch in several major cities, including Shenzen, Shangai, Beijing, Chengdu, Changsha, and Suzhou.

China has been conducting lotteries across the six cities to further boost adoption. Since October, the giveaways have distributed more than $40 million. China has also joined forces with the United Arab Emirates, another country implementing a digital currency, to create a global payment network based on CBDCs. Current members include the BIS Innovation Hub, the Hong Kong Monetary Authority, and the Bank of Thailand.

China and the United Arab Emirates aren’t the only countries preparing for a CBDC world. Indonesia recently announced its plans to launch a digital currency due to an explosion in digital transactions amid the COVID-19 crisis.

This news was originally published at Crypto Briefing.