But Analysts Caution That Widespread Adoption Must Be Gradual, As Embracing The E-Yuan Will Be ‘An Educational Process And A Cultural Shift’

- Increased security and greater internationalisation of the yuan are among the benefits offered by China’s new digital currency

- But Analysts Caution That Widespread Adoption Must Be Gradual, As Embracing The E-Yuan Will Be ‘An Educational Process And A Cultural Shift’

To mitigate “financial risks”, China needs to weigh the pros and cons of loosening its strict capital controls using a central bank digital currency, according to the director of digital finance at China’s prestigious Peking University. The so-called e-yuan is mainly intended to be used in the domestic retail sector, but a big question that is often discussed is whether it could be useful in internationalising the yuan, in addition to helping with China’s market liberalisation efforts and enabling the central bank to track capital flows.

On one hand, the burgeoning e-yuan serves to enhance authorities’ surveillance capabilities in China’s cross-border payment system, effectively allowing for its currency to be monitored in real time, according to Peking’s Huang Yiping, who also specialises in macroeconomic policy and international finance. This would help authorities detect economic risks faster, and deploy mitigation efforts earlier.

“But on the other hand, there will be speculators and [bad actors] who might also use the technology to do things very fast,” Huang said. “I tend to believe that technology is always a double-edged sword. The main concern is that, if you don’t do this properly, there could be significant financial risks or even a financial crisis.”

He was speaking during an online panel discussion about central bank digital currencies, hosted by the SCMP’s Redefining Hong Kong Series, on Thursday. China’s financial services sector remains largely closed to foreign investors, and cross-border money flows are restricted by draconian capital controls that are meant to prevent an exodus of outflows in a crisis. But the strategic road map laid out this year in China’s 14th five-year plan indicates that this is going to change, Huang said.

As the United States has stepped up in its capacity to impose financial sanctions on China, it is more important than ever to bypass the US dollar by increasing the yuan’s use in global finance, trade and investments.

“The opening up [of China’s] capital account, and also the internationalisation of the currency would be key policy goals to be achieved,” Huang said. “But you still have to be very gradual, because you have to [strike a] balance between the benefits of an open capital account with the risks that come with it.”

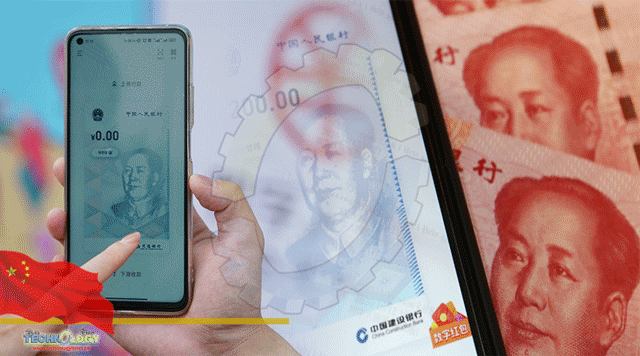

Cybersecurity and money-laundering prevention are key features of the e-yuan, which is being gradually rolled out across the country in the form of trials involving millions of people and more than 2 billion yuan (US$314 million) so far.

The government, banks and e-commerce platforms need to have more capabilities to protect customer data – Henry Zheng, EY

China has thousands of domestic banks, and the e-yuan could help them boost their ability to look into the digital records of fund transfers. This, in turn, could help the central bank weed out malpractice that might otherwise have been conducted with cash, according to Henry Zheng, who specialises in fintech and innovation at accounting firm EY.

Zheng noted that the benefits of using the e-yuan are readily apparent to Chinese consumers – a trade-off for sacrificing their personal data privacy in the interest of cybersecurity and national security. In recent weeks, Beijing stepped up its crackdown on tech giants, with allegations of user data being illegally collected. Didi Chuxing, the nation’s biggest ride-hailing service, was removed from app stores this month on “national security” grounds, just days after it went public on the New York Stock Exchange.

“It will be an educational process and a cultural shift,” Zheng said. “People will take the convenience [of the e-yuan] and personal data [privacy] into a more balanced consideration. Regardless, the government, banks and e-commerce platforms need to have more capabilities to protect customer data.”

China’s mobile-payment market is currently dominated by Alibaba’s Alipay and Tencent’s WeChat Pay, which have created a massive online ecosystem offering services and products based on their digital wallets. Alibaba owns the South China Morning Post.

Huang noted that, moving forward, nine designated institutions have been authorised by the PBOC to design their own wallets, segregating the data set into portions of transaction information collected by each of the nine wallets. The PBOC, however, will have access to all of the data, as the e-yuan will be used by all of the institutions’ digital wallets.

Benedicte Nolens, head of the Hong Kong Centre for the Bank for International Settlements (BIS) Innovation Hub, said the e-yuan’s traceability via “controlled anonymity” is crucial to the PBOC’s money-laundering prevention efforts, as large, suspicious transactions involving the e-yuan may be traced to prevent and punish criminal behaviour.

The BIS and the central banks from China, Hong Kong, Thailand and the United Arab Emirates are tackling regulatory complexities and transparency issues related to cross-border payments that involve wholesale digital currencies for trade. For Hong Kong, despite being a technologically advanced city, it would still need to tackle pain points and move towards digital automation in different trade processes to boost international use of the e-yuan, Nolens said.

“Trade actually is an incredibly complex topic because it touches off on many more points than just the currency itself. You will need to have very well automated customs,” she said. “Ideally, you also need to have automated identity systems for corporate registries.”

Carie Li, an economist at OCBC Wing Hang Bank, said that the e-yuan could potentially be used in cross-border retail and tourism spending by Chinese consumers in Hong Kong, especially given the similarities in the architecture of the digital currency operating systems expected for Hong Kong and China.

The e-yuan and an e-Hong Kong dollar would facilitate human flow and financial integration of the Greater Bay Area in line with the country’s top economic development initiative in the coming years, Li said.

“If the e-yuan is widely adopted after the Winter Olympics, then we may see an increase of its use in Hong Kong by Chinese visitors,” Li said. “It’s possible the e-Hong Kong dollar will also be used by Hong Kong people in Macau and China over time.”

This news was originally published at SCMP.